The corporate culture after post-merger integration

You cannot merge two companies without it having a major influence on the corporate cultures. The corporate culture after the post-merger integration process has to be designed very carefully so it includes the best parts of the two original corporate cultures. But it also has to support the new strategy for the company. That is why we often need to introduce some new values to the corporate culture. Introducing these new values is a complex but necessary task. It is best facilitated by a neutral partner with expertise and experience in this field. Unfortunately, some CEO's believe they possess this expertise themselves or they simply don't think that corporate culture change is important at all.

Why do post-merger integration processes often fail?

Why is it that 2/3 of all mergers and acquisitions fail to meet their original objectives due to cultural clashes? Our research shows that it is because the cultural friction is ignored or underestimated. And also because the management doesn't have the necessary skills and/or time to do a proper integration. If your company shouldn't end up between the 2/3 of the companies that fail we suggest you contact us as early as possible. This way we proactively can plan the post-merger integration process instead of agreeing on a damage control assignment.

%

So many M&A's fail to meet their objectives

Why is it that 2/3 of all mergers and acquisitions fail to meet their original objectives due to cultural clashes? Gugins research shows that it is because the cultural friction is ignored or underestimated.

The post-merger integration process usually goes wrong because

- Management loose focus as soon as the deal is signed

- Management doesn’t know how to tackle the post-merger integration process properly

- Management has to deal with both the current business and the post-merger integration process

- The cultural friction and resistance is often hidden

This article in Financier Worldwide deals more with the cultural integration

Getting a great corporate culture after the post-merger integration process is like baking a delicious cookie

You can compare a successful post-merger integration process with baking a delicious cookie. You have a number of fantastic ingredients, which have to with put together in the right quantities and in the right order. It then has to be baked perfectly. This is the only way you will get the perfect delicious cookie that tastes far better than any of the ingredients alone. If you fail you have wasted the ingredients - and a great opportunity. That is why you have to be a good baker to succeed.

Integrating organisations is no different. You have to understand the cultural and sociological dynamics and know how to facilitate the post-merger integration process. If you fail, your best employees and managers will leave together with your best clients. They leave because they feel left alone, disappointed and frustrated. And they have no clear image of what the future is going to look like

You might also like this

An intensive 1/2-day Gugin course teaching leaders to lead through change e.g. a post-merger integration

You need somebody from outside to assist you

There are several good reasons for why you should let an external specialist like Gugin help you with the post-merger integration process:

- A lot of emotions are at stake during a post-merger integration process. It is therefore important that the people who facilitate the integration process are neutral. This is the only way to avoid internal conflicts and secure the momentum of the process.

- You are great at running your business but you might not be great and take your company through a major change

- Momentum is crucial. To maintain the support from your organisation for the merger or acquisition you need to show them results - fast. This is only done by keeping a steady momentum in the integration process, getting the priorities right and bring the right skills to the table at all times. It might be difficult for you to do that while you at the same time have to run the daily operation of your business.

- Because of our experience, we can discover and deal with many of the obstacles before they become a real problem. And we also often identify synergies you would probably never have thought of

How will Gugin help you develop a new corporate culture after post-merger integration?

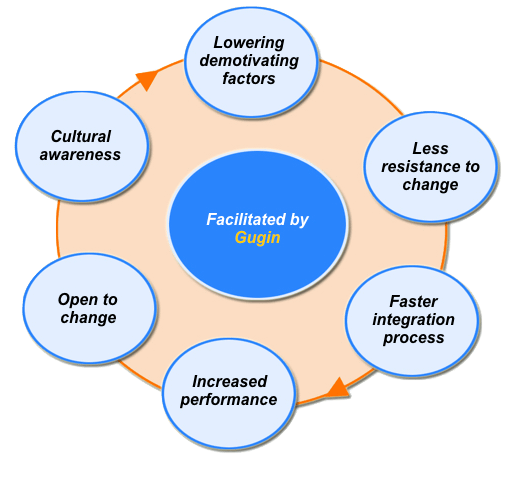

When people have to change they have to feel safe. That goes for all of us. We create a safe environment by assessing the current culture and the demotivating factors for change and address the collective fear different groups of people have. When we can control our fears we are more willing to change, which is crucial in a post-merger integration process.

When people have to change they have to feel safe. That goes for all of us. We create a safe environment by assessing the current culture and the demotivating factors for change and address the collective fear different groups of people have. When we can control our fears we are more willing to change, which is crucial in a post-merger integration process.

When we are more willing to try something new the integration process goes a lot faster and the dive we always see in organisational performance after a merger or acquisition becomes significant shorter

Often when we try something new we say "Why didn't I do that before?". But that fact is we need that little push to take the first step. This is one of the key things we facilitate in the post-merger integration process.

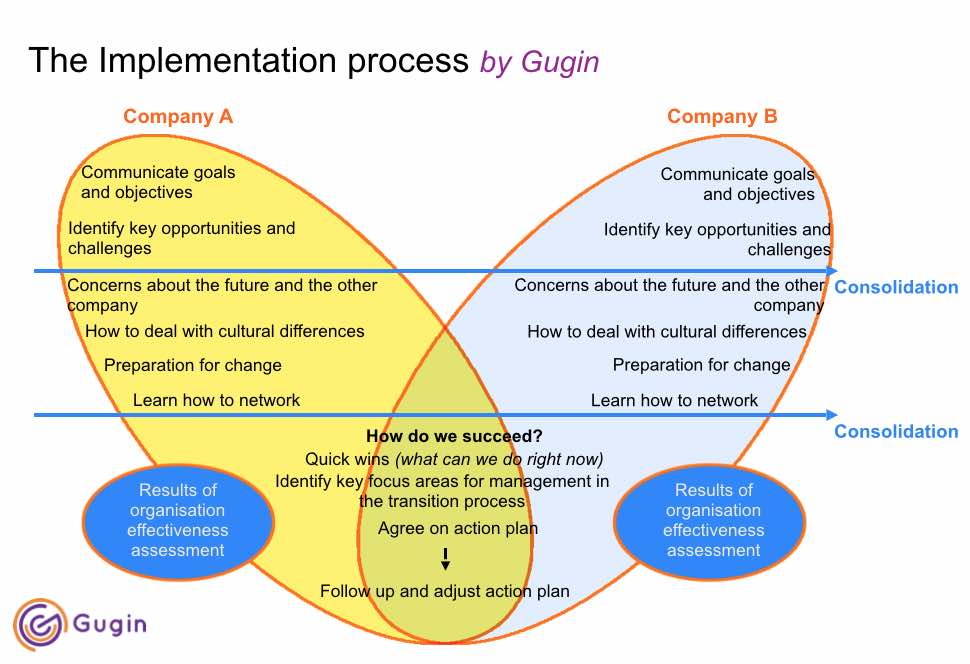

Gugin´s process of integrating 2 organisations is happening stepwise with a number of checkpoints on the way to make sure that the organisation is ready to move on to the next step.

Workshops during the post-merger integration process

1. Communicate goals and objectives (1/2 day)

To make sure everybody understands why the organisations merge and what is going to be achieved; Drafting of the integration plan

2. Identify key opportunities and challenges (1/2 day)

How can we synergize from bringing the organisations together and which problem we may face. Will our corporate and national cultures work together?

3. Concerns about the Future (1/2 day)

To identify the demotivating factors for integrating. Reducing people’s fear is essential in successful integration.

4. Cultural differences (1/2 day)

What is culture and why are we different and how do we deal with this diversity. In which areas will we accept diversity and in which areas will we not?

5. Prepare for change - networking (2 days)

A 2 day course, where the employees will improve their self-confidence and learn to seek opportunities outside their usual network

6. How do we succeed - Quickwins (1 day)

Groups of people from both companies will identify quickwins that can serve as models for the ongoing integration process. The results of the organisational effectiveness analysis is used as input.

7. Prioritise management issues in the integration process (1/2 day)

The groups identify key areas for the management to focus on based on the current work and the results of the analysis.

8. Follow up and adjust integration plan

Assess the current plan and make the necessary adjustments.

What you can do to better prepare your organisation

When we assess why post-merger integration processes often get off track fear, communication (or lack of), expectation setting and cultural misunderstandings are the main reasons, but not necessarily in that order.

Fear is usually developed because we lack information or because we misinterpret the situation. I guess you know that feeling from many situations in life already. So training the organisation to become more cultural intelligent is a very good investment. Not only will the post-merger integration process run more smoothly you will also experience a more positive attitude because the higher level of cultural intelligence gives people more confidence and they develop less fear for what is going to happen. Gugin can provide the basic training both as traditional class facilitation or as an online course